One of the many things you will have to deal with after a DUI conviction is your car insurance. If you’re thinking that your rate is going to go up, guess what? It will.

A lot.

I’ve been driving since I was 16, never involved in an accident, never got a speeding ticket, and before this, had a clean driving record and excellent credit. My six-month premium for Florida car insurance, with lease-required minimums, and safe driving discounts was $468.00 for a model year 2020 luxury vehicle with $1000 deductibles through State Farm.

Once I was convicted of my DUI that $468.00 premium vanished along with coverage from State Farm.

In Florida, once you are convicted of driving under the influence, you are required to obtain what is called an FR-44 in addition to your auto insurance. While FR-44 has gotten the nickname “DUI Insurance,” it isn’t.

An FR-44 form is a document of financial responsibility used in Florida that proves you’ve purchased car insurance. If your license is suspended, your state might require you to prove that you have car insurance before your license gets reinstated.

FR-44 is simply a certificate that verifies the car insurance you have meets the state’s requirements for financial responsibility. Not all auto insurance companies offer FR-44 certificates which is why after almost a decade with State Farm, I had to switch companies.

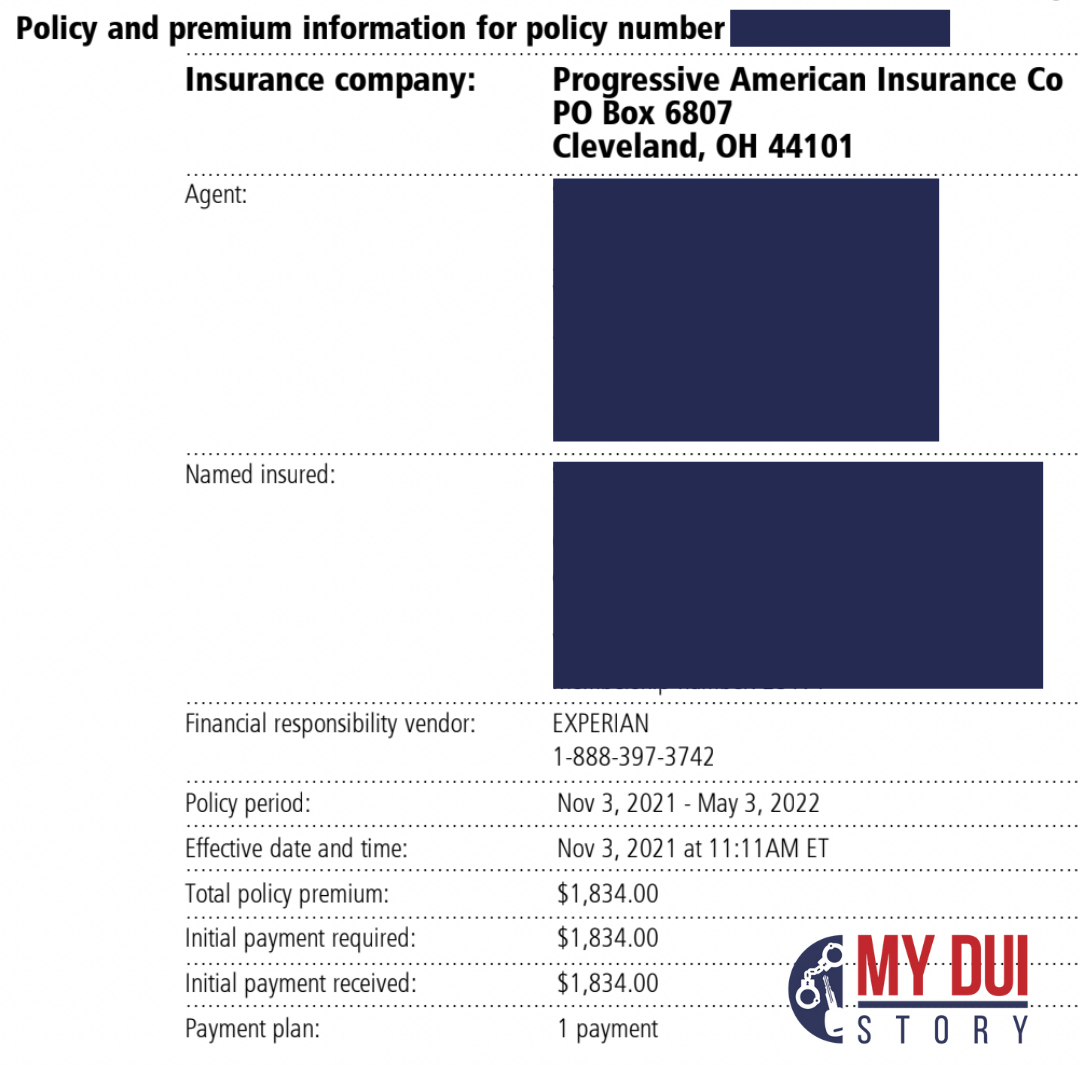

After receiving quotes, the best deal I got was from Progressive. At the whopping cost of $1834.00 for six months – four times the cost of what I was paying previously. Plus, FR-44 insurance must be paid in full at the time the policy is written.

For many, the cost of car insurance after a DUI is out of reach. However, DO NOT DRIVE WITHOUT INSURANCE!

Before you can get your driver’s license back, or apply for a business purposes only hardship license after a DUI conviction, you MUST have car insurance and the FR-44. You will be required to show proof at the DMV prior to getting your license. You are also required to have the following minimums:

- $100,000 for bodily injury or death to one person

- $300,000 for bodily injury or death of two or more people

- $50,000 for property damage liability

Additionally, in Florida FR-44 is required for three years after a DUI conviction. So for me, over the course of the next three years, my car insurance will cost me nearly $12,000 as opposed to $3,000 if I didn’t have a DUI.

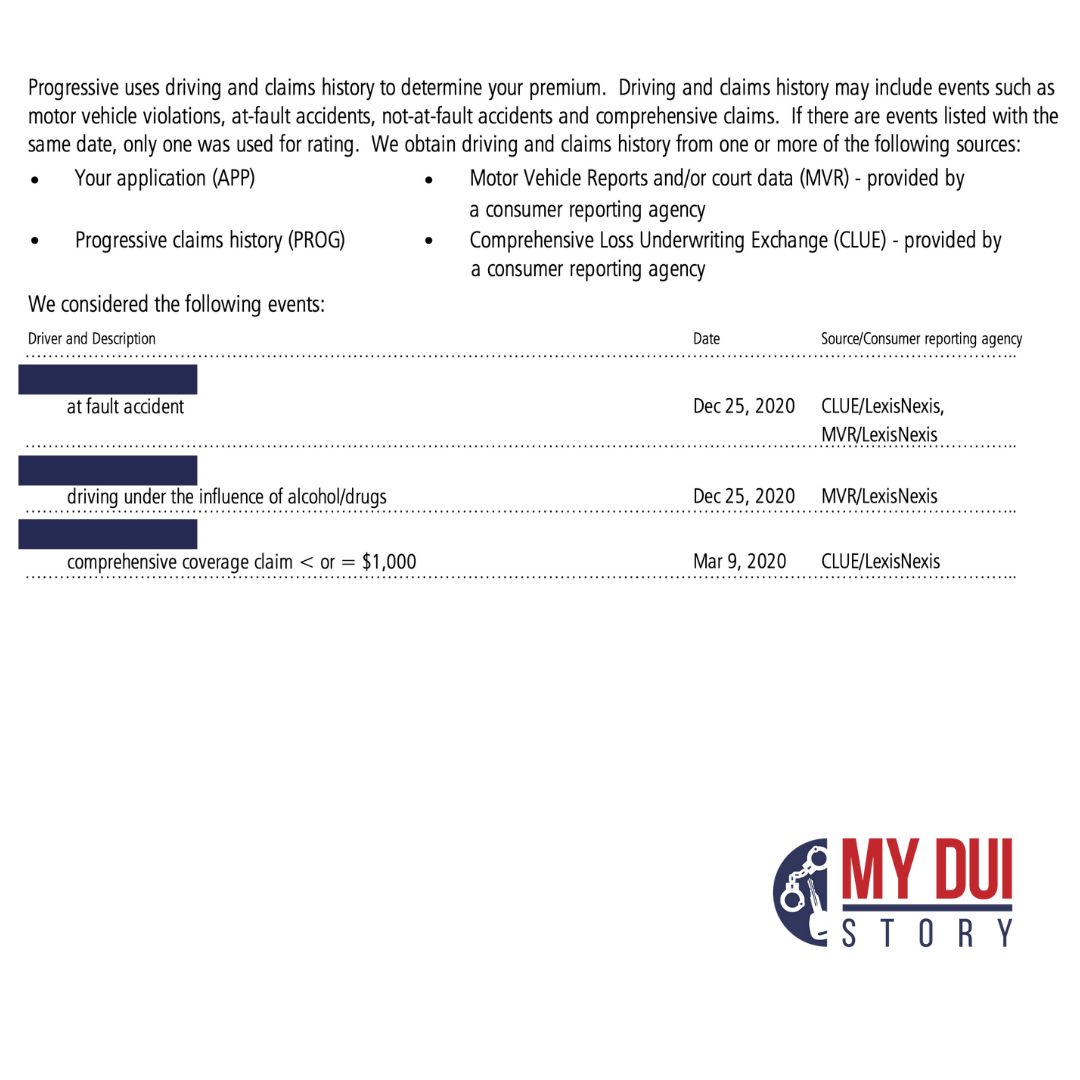

If you’re thinking that your insurance company won’t find out about your DUI, you’re wrong. When you purchase insurance or renew your policy, your car insurance company will provide you with a list of what went into determining your rate which is basically a list of things on your driver’s record.

Also, as I said before, you have no choice but to get the FR-44 certificate after a DUI in Florida and carry it for three years. If you fail to purchase the FR-44, your driving privileges will be revoked by the DMV.